在B2B领域,传统的企业信用风险评估方式往往流程繁琐、效率低下且容易产生偏见,已难以适应快速变化的商业环境。RocketFin应运而生,它通过先进的人工智能技术,正在彻底变革这一局面。该平台的核心在于利用AI自动化整个信贷决策流程,使其变得更快速、更可靠、更具包容性。

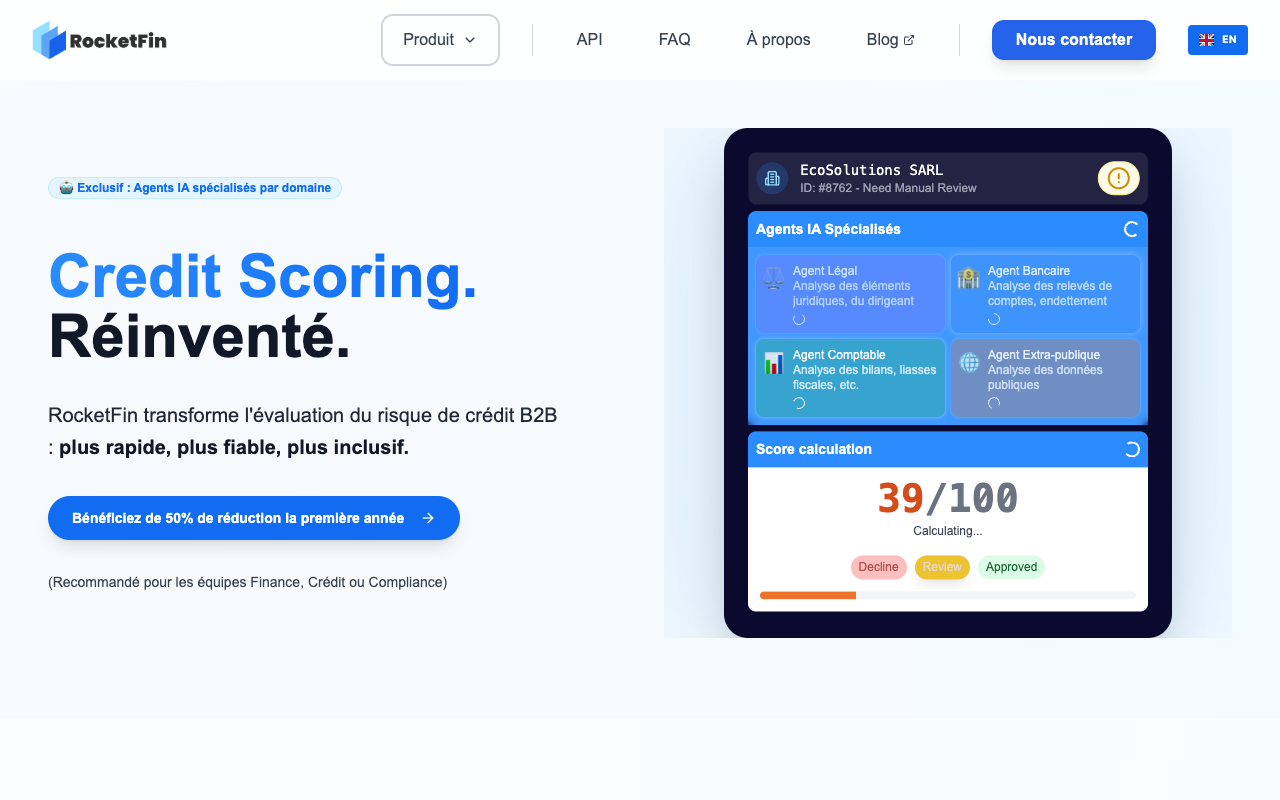

RocketFin的突出优势在于其实时评分能力。它部署了专业的AI智能体,能够综合分析企业的法律信息、银行流水及公开数据等多维度信息,为金融团队提供基于最新数据的决策支持,极大减少了人工处理时间。此外,平台提供可自定义的评分阈值与预警机制,允许企业根据自身需求灵活调整标准。

其动态持续的评估体系能自动适应新数据,清晰可视化客户财务状况的演变,帮助B2B金融机构前瞻性地预判风险并做出主动决策。这不仅显著提升了评估的效率和准确性,更从根本上优化了企业的风险管理策略。总而言之,RocketFin为B2B信贷评分提供了一个前沿的AI驱动解决方案,通过流程自动化与智能分析,赋能企业实现更精准、高效的信用风险管理。

RocketFin is revolutionizing the way businesses assess credit risk in the B2B sector. By leveraging advanced AI technology, RocketFin automates the credit decision-making process, making it faster, more reliable, and inclusive. Traditional methods of evaluating credit risk are often outdated and cumbersome, leading to slow and biased decisions. With RocketFin, businesses can benefit from a streamlined approach that enhances efficiency and accuracy.

One of the standout features of RocketFin is its real-time scoring capability. This allows finance teams to make informed decisions based on up-to-date information, significantly reducing the time spent on manual processes. The platform offers specialized AI agents that analyze various aspects of a business, including legal elements, banking statements, and public data. This comprehensive analysis ensures that all relevant factors are considered, leading to better credit assessments.

The benefits of using RocketFin extend beyond just speed. The platform provides customizable thresholds and alerts, ensuring that businesses can tailor their scoring criteria to fit their specific needs. With dynamic and continuous evaluation, RocketFin’s scoring system adapts automatically to new data, providing a clear visualization of a client’s financial health. This is particularly valuable for B2B finance players, as it enables them to anticipate risks and make proactive decisions.

In conclusion, RocketFin offers a cutting-edge solution for credit scoring in the B2B landscape. By automating the process and utilizing AI technology, businesses can enhance their decision-making capabilities and improve their overall risk management strategies. Explore more about RocketFin and how it can transform your credit assessment processes by visiting RocketFin .